Theia Proposal

-

Abstract

This proposal introduces Theia Router, a decentralized cross-chain DApp developed on the CTM-MPC network and C3Protocol, incubated by ContinuumDAO. The Theia Router aims to be the pioneering application within the CTM ecosystem, addressing operational challenges such as fee adjustments, response time enhancement, service quality improvement, and chain/token deployment.

Motivation

While the current CTMDAO governance system effectively manages MPC network decentralization, it faces challenges in scalability and flexibility. Operational issues such as inefficient fee structures, slow response times, and limited chain/token support hinder the potential growth and usability of Theia Router in this system. As a new Router iteration, Theia aims to overcome these limitations, providing a more robust, efficient, and user-friendly cross-chain routing solution.

Specification

Overview

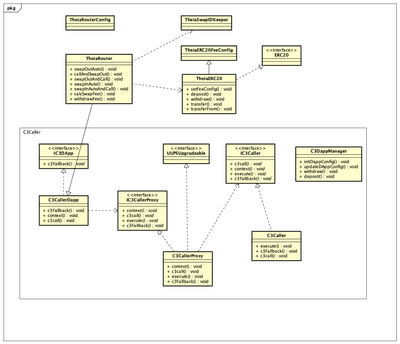

The Theia Router signifies a significant evolution in the cross-chain routing capability of the CTM-MPC network. By integrating decentralized contracts with C3Protocol within the CTM-MPC network, it aims to directly serve users with improved efficiency and reliability.

C3Protocol Nodes Structure

Theia utilized the robust design of C3Protocol that is fully governed by ContinuumDAO. The key access of the protocol only can be changed by on-chain voting.

Contracts

Theia will register in C3Caller as a DApp, handling pre-stored fees and DApp whitelisting.

- The Theia cross-chain fee will be calculated on-chain.

- The Theia cross-chain fee will be locked in the Contract separately.

Revenue Model

- For Theia: Theia generates income from cross-chain users with a flexible fee structure based on the source or target chain.

- For Continuum: CTM-MPC contract call income is generated from Theia for all ContinuumDAO members.

Scope

The proposal covers the Theia design, deployment, audit, and operational management of the Theia Router, including node services, contract optimizations, revenue model adjustments, and a new contract management model.

Success Criteria

Successful implementation of the Theia Router will be measured by:

- It enhanced transaction processing speed and efficiency.

- Effective management and reduction of operational costs.

- User satisfaction and increased adoption of the Router within the cross-chain community.

- Stable and secure operation of the Router system.

Timeline/Budget

A detailed timeline and budget will be formulated post-approval, focusing on the development, testing, deployment, and operational setup phases. A preliminary estimate of the project duration is 1-2 months, with a detailed budget to be determined based on resource requirements.

Conclusion

The Theia Router, as a decentralized project incubated by CTMDAO, promises to significantly enhance the cross-chain routing capabilities of the CTM-MPC network. With improved operational efficiency, scalability, and user experience, it aims to set a new cross-chain communication and transaction processing standard.

-

THEIA Token

Token symbol: THEIA.

Diminishing emissions of THEIA, programmed into the contract with an inverse emission rate. The emission would never end, but would continuously reduce.

Initial Circulating Supply: 10 million.

THEAI Emissions

Year Emission Rate/Year Tokens Emitted Circulating Supply 0 10,000,000 0 10,000,000 1 5,000,000 6,931,472 16,931,472 2 3,333,333 4,054,651 20,986,123 3 2,500,000 2,876,820 23,862,943 4 2,000,000 2,231,435 26,094,378 5 1,666,666 1,823,215 27,917,593 6 1,428,571 1,541,506 29,459,099 7 1,250,000 1,335,314 30,794,413 8 1,111,111 1,177,830 31,972,243 9 1,000,000 1,053,605 33,025,848 10 909,090 953,101 33,978,954 20 476,190 40,445,227 50 196,078 49,318,259 100 99,009 56,151,209 The Theia project is incubated by ContinuumDAO and its treasury could receive 20% of the initial supply, i.e. 2 million THEIA. ContinuumDAO must decide what to do with these, but I think that we should keep 1 million in the treasury and distribute 1 million to veCTM holders over 2 years. The remaining 1 million veTHEIA position would give ContinuumDAO a large vote in any Theia proposals.

The remaining 8 million THEIA would be for Theia to decide how to use. We could split this into THEIA that is controlled by the Theia DAO in its treasury to be split between the different chains and acting as a reservoir for bonus rewards (4 million?). The rest of the THEIA would be available for the project team to use, e.g. for liquidity on DEXes/CEXes, for rewarding contributions, for airdrops, or for attracting other projects to the ecosystem.

THEIA Utility

THEIA has two main purposes:

(1) Governance: When vested into an NFT veTHEIA (max lock = 2 years?), it can be used to vote on DAO proposals within a limited scope -

(a) Which assets are to receive rewards for liquidity provision,

(b) The total THEIA rewards per asset per day, to be funded from the daily THEIA emission and possibly supplemented from the DAO treasury,

(c) The percentage of rewards to be awarded on each supported chain for that asset.

(d) The increased reward rate for those wallets holding vested THEIA in their veTHEIA. A liquidity provider would receive THEIA rewards for providing liquidity on a chain if their veTHEIA held no THEIA, but would receive extra rewards in proportion to how many vested THEIA they had on that chain, proportionate to their vested power compared to the total on that chain. The Theia DAO can decide how much extra this is (see the factor f in the Reward Model section below). A sensible increased reward rate might be double if a wallet held all the vested THEIA on that chain.

(e) In addition the Theia DAO can vote to use up to 50% of the USDC profits (after paying for CTM fixed fees, gas and DEX swap fees) to buy THEIA from the market for its treasury to top up bonus rewards, or to burn THEIA from the treasury.The remaining 50% of USDC profits are at the disposal of the Theia team, to pay for their running costs such as salaries and fixed infrastructure costs.

(2) Fee Distribution

The intention of THEIA rewards for liquidity provision are twofold - to attract liquidity and to incentivise liquidity provision to where it is most needed.

THEIA Locking

THEIA are locked into veTHEIA using the same mechanism as used by Continuum. The major difference is that veTHEIA is an held on one chain. The veTHEIA records the total liquidity of that wallet address on every chain for each rewarded asset at 0000 UTC on each day (in practice, only changes would be recorded in the smart contract to reduce storage costs), as well as the locked THEIA vested power. These figures are used to calculate the daily THEIA rewards.

The THEIA can be liquidated with a 50% penalty of the vote power accruing to the treasury, in the same way as veCTM.

Fee Model

The fees that users pay depend on which asset types they are moving cross-chain. All fees are in USDC (plus gas) and go to the treasury. By using only USDC for fees, it will be straightforward to implement EIP4337 Account Abstraction at a later date.

- Native Assets: Theia will provide rewards for liquidity provision for a list that includes from the outset USDC, ETH, BTC, USDT, DAI, but through DAO voting, this list could change. There may be other protocols that wish to provide liquidity for their native assets, even though there will be no rewards, e.g CRV, LINK etc. For users moving these assets cross chain, they pay a fixed fee in USDC + gas, for any amount moved, unless they want to move more than 80% of the liquidity available on the destination chain. The fixed fee could be 5 USDC. For amounts more than 80% of available liquidity, they are charged a progressively higher fee, reaching 10x (1000%) the 5 USDC fee, or a max fee of 50 USD if they try to use all of the liquidity on the destination chain. This would be implemented as a parabolic function using a lookup table in the fee smart contract. The actual fees charged would be under the control of the team and would be periodically reviewed.

- Non-Native Assets For assets that use the mint/burn contracts of Theia, the amount that can be transferred is not limited by a liquidity pool. I think that we should charge a fixed fee of say 5 USDC plus gas for transferring any amount cross-chain.

Reward Model

Liquidity providers for assets that receive THEIA rewards can claim their rewards at most once per day. They can claim for each unclaimed day up to and including the previous day.

When a user makes a cross-chain transfer requiring more than 80% of the liquidity pool, the extra fee beyond the base fee is sent to the treasury excess fee pool for that asset. The total USDC of the asset pool from the previous day, multiplied by a factor (0.5?) is used to calculate the bonus THEIA reward for each asset on that chain for the current day, B using a DEX price point. The total reward per asset per chain is now Q + B, where Q is the DAO decided base reward. The nominal reward to be received for each veTHEIA for the previous day is

rn = 0.5*(s + f*p)*(Q + B),where s is the share of the liquidity pool for that asset on the chain at 0000 UTC and p is the vote power of the veTHEIA as a proportion of the total vote power on that chain at 0000 UTC and f is a weight factor decided by the DAO. The 0.5 is because only 50% of rewards are paid to liquidity providers, the remainder going to the team.

We must limit the total rewards for a day to 0.5*(Q + B) over all veTHEIA, or equivalently,

t*SUM(s + f*p) = 1so that the actual reward for a veTHEIA is

r = t * rnThere is no need to swap USDC rewards for the bonus B each day, since THEIA from the treasury can be used instead and any user can swap USDC for THEIA using a dedicated UniswapV3 function to keep it topped up via a button in the frontend. The incentive to do this is that users can make the swap before selling their THEIA rewards, to maximise the price.

The claiming mechanism uses C3Caller to determine the liquidity on each chain before allocating THEIA to liquidity providers. This will be a reference use of C3Caller for other dApps.

Advantages of the THEIA token model

(1) Programmed diminishing emission of THEIA, so early participants will benefit.

(2) Vesting THEIA in veTHEIA will not be necessary to get rewards, but it will increase the rewards for liquidity providers, at the same time as locking up a lot of circulating THEIA.

(3) Holding veTHEIA for governance will be desirable for protocols wishing, through voting, to solicit rewards for their token’s liquidity provision.

(4) The veTHEIA model will ensure that governance is enacted by holders with a longer term outlook for Theia.

(5) THEIA can be used by the Theia team to pay for development, including to ContinuumDAO.

(6) The proposed reward system is superior to other cross-chain protocols, such as Stargate. It will achieve a rapid increase in liquidity for native assets cross-chain, without providing too much reward for pools that are already well capitalised, but encouraging liquidity to be moved to where it is most needed and to where the highest rewards can be gained. It is decentralized, with no need for the team to fill reward pools.

-

Hello,

you guys put quite some effort in this already! As a non technical guy tho it's pretty hard to grasp the details

Did you guys put this proposal on the forum together? And can I read your part @Selqui as a more detailed part of @Jerry his initial proposal?

Would it be possible to put the tokenomics/reward/fee/locking part in a visual representation? That would help me to get a better understanding of it all.

-

Emission numbers look great. I also agree with the initial distribution. Also agree with governance.

A $5 fee sounds reasonable and competitive. Regarding the max fee of $50, is it too cheap for someone who is using up 80% of liquidity on the destination chain? If cross-chain liquidity is all but dry, I suspect users would be willing to pay more.

The reward model calculations are a little beyond me but the key variables look good.

Does Theia pay CTM for using its network?

Thanks Jerry and Selqui for putting this proposal together.

-

@Raini-Ng Thank you for your comments. I will increase the multiplier for using all of the liquidity to 20, so if the base fee is 5 USD (can be chnaged by the Theia team), then the max fee would be 100 USD.

Regarding fees to Continuum - yes Theia pays per byte for sending messages cross-chain and all router operations will need to do this. The fee per byte is set by Continuum and depends on the chain.

-

Good job guys it very technical we lucky to have the contributors guiding CTM were it needs to be decentralised and I agree we need Theia for the reasons stated in the proposal full support here !! Can the Theia team decide to move from CTM mpc network to another chain say in search of cheaper fees if CTM voted to increase fees or would they be tied into a contract and always be part of CTM as they were incubated by CTM I think I read right we in this together always ? Right

-

@Raini-Ng Thank you for your thoughtful scrutiny. Let's double the max fee penalty factor, so that if the standard fee is 5 USD, the max fee becomes 100 USD.

In the model, I suggested that Theia pays out in THEIA. The supply dynamics of CTM are not really designed for rewarding liquidity provision.

The idea with veTHEIA is that it is on one chain (Arbitrum most likely), but it has an account of liquidity provision by the holder on ALL chains. For a new liquidity provider, they first go to the chain that they wish to provide liquidity on (let's say Fantom for example) and transfer tokens (ETH, USDT etc.) to a vault on Fantom owned by Theia. Back on Arbitrum, they interact with their veTHEIA to make a cross-chain call to add the liquidity in the vault to the router on Fantom and to add a record to their veTHEIA that they have done so. They can then collect THEIA rewards every day on Arbitrum from all chains that they have liquidity on. They can remove their Fantom or other liquidity any time that they want to.

-

This has now moved to a Treasury Vote, after integrating the comments from here. Please do vote https://forum.continuumdao.org/topic/25/004-final-vote-theia-proposal

-

What's the current idea for how often

- Q, the DAO-decided base reward and

- f, the DAO-decided weight factor

will be adjusted?

-

@tomKyle8905 Good questions. These two factors effectively decide how much rewards in THEIA should be allocated from the emissions and what proportion of the rewards go to THEIA stakers vs. liquidity providers. This would be up to the DAO to decide, but since it takes 15 days for a vote, I don't think that they could change more frequently than once per month and in fact for a good user experience, perhaps they should not change too often - at a guess, I imagine that it could be 3-6 months between changes.

Increased usage of Theia leads to higher collected fees and more buy pressure for THEIA and also there are reduced emissions of THEIA over time, meaning that Q should steadily reduce, unless the DAO decide to incentivize liquidity provision.